Get in touch

Type in your inquiry and we'll reply quickly

Thank you!

We use cookies to provide the best site experience.

Hottest new products

on the American organic

food market

on the American organic

food market

We develop, launch, manage and distribute grocery product lines that disrupt traditional food market categories and generate extra attention of buyers in U.S. and beyond

our brands

2/3

I'M VEGAN

bold launch in the fastest-growing sub-category!

Hottest new products

on the American organic

food market

on the American organic

food market

We develop, launch, manage and distribute grocery product lines that disrupt traditional food market categories and generate extra attention of buyers in U.S. and beyond

our brands

1/3

BRISLING

SARDINES

SARDINES

record-breaking quick entry into

Whole Foods market

Whole Foods market

Hottest new products

on the American organic

food market

on the American organic

food market

We develop, launch, manage and distribute grocery product lines that disrupt traditional food market categories and generate extra attention of buyers in U.S. and beyond

our brands

3/3

CRUNCH

INSTINCT

INSTINCT

world's first food product to acquire

«Global Footprint Network» certificate

«Global Footprint Network» certificate

I'm Vegan

A brand owned/managed by Liberty Trade Inc.

After it's first presentation on the ExpoWest exhibition I'm Vegan received more pre-orders than any other brand managed by Liberty Trade Inc. Vegan pate that imitated taste of a fish pate generated most demand.

Origin: EU

Launch in the United States: 2018

Other markets include: Latvia, Lithuania

SKUs: 6

Certifications and claims acquired: Vegan (The Vegan Society, UK), Dairy Free, Natural Source of Protein, Low Cholesterol

Crunch Instinct

A brand owned/managed by Liberty Trade Inc.

Crunch Instinct became world's first grocery product to be certified by Global Footprint Network - an influential international environmental watchdog.

Origin: RF

Launch in the United States: 2019

SKUs: 4

Certifications and claims acquired: Global Footprint Network (US), NON-GMO Verified, Vegan (The Vegan Society, UK), Gluten free

Brisling Sardines

A brand owned/managed by Liberty Trade Inc.

Brisling Sardines became a sensation on the American market when it entered Whole Foods only months after it's launch (while many U.S. brands struggle for years to be listed by WF).

Origin: EU

Launch in the United States: 2016

Other markets include: Dominican Republic, Belgium, Latvia, Estonia, Lithuania

SKUs: 5

Certifications and claims acquired: Kosher (K), Wild Caught Sustainable, Gluten Free, Recyclable (ALU)

Product niche search

Natural/organic is a very competitive market. A product that was not developed to fit a specific market niche will not sell.

Liberty Trade Inc. utilizes own U.S.-based personnel as well as selected contractors to conduct market niche research in record quick time and at a fraction of a cost:

Results of a market niche research:

clear understanding of a specific market segment to adapt a product for

Not sure which of your products is best for U.S.?

Allocation of retailers with highest demand for a product category

Research of product certifications and packaging parameters required for differentiation and profit maximization

Insights from U.S. brokers, distributors and retailers about emerging and falling trends

Allocation of an ideological/ marketing direction best fit for selected sales channels

choice of SKUs with maximum sales potential in first 1-2 years

business model (sales forecast, pricing, profit margin)

several unique product concepts allowing to stand out from all current competitors (also technical specs. for designers)

Product adaptation for U.S. market

To execute a successful launch on U.S. natural/organic market a product needs to be completely re-developed in order to meet every requirement of the sales channel.

Our company began as an exporting manufacturer and grew into American vendor and distributor. This is how we gained experience in running/managing every aspect of product adaptation for it's sales in the United States.

Results of a product adaptation:

manufacturer is 100% prepared to produce a first quantity of product that is designed to succeed in U.S.

Want to make sure product adaptation is done right?

Laboratory analysis of product's nutritional facts. Product labelling.

Product branding. Packaging design. Development of marketing collaterals.

Price structuring and opening deals for selected distributors and retailers.

Product social function or «Super Idea» intended to generate necessary attention of buyers.

Nationwide sales and distribution in the United States

Once the product hits U.S shelves, duty of the vendor is to stimulate sales and market expansion in order to keep the sales channel members happy and interested.

Liberty Trade Inc. in-house resources allow us to supervise and execute all work related to product management and sales growth:

Ways to grow sales:

product line expansion

Your product is ready for big sales?

Certified vendor, warehouse (Fair Lawn, New Jersey)

Direct contracts with largest federal distributors of natural/organic products

U.S.-based staff of product managers and marketers

Marketing activities (exhibitions, in-store promotion, web, influencers, other)

organic growth

aggressive market entry in large chains

Certification

Liberty Trade Inc. technical team routinely carries out management of acquisition or prolongation of a variety of certifications.

Correct choice of certificates and experience in managing the certification process can save a significant amount of money to the manufacturer and it's investors.

Types of certificates to work with:

mandatory

Require certification done right?

management certificates

religious (Kosher, Halal, etc.)

lifestyle and tribes (Vegan, Paleo, etc.)

social and ecological (Global Footprint Network, Woman-Owned)

other

Test sales & merchandising

Every supplier wants to work with a major U.S. distributor or supermarket chain. But no chain is willing to buy a new foreign product that has no history of sales in America. This is why so many suppliers wait 3-5 years just to get listed.

We have learned to move quickly! Liberty Trade Inc. employs own staff of merchandisers to conduct test sales to U.S. independent stores. This allows us to verify product concept and generate sales statistics necessary to enter large natural/organic supermarket chains later on.

Types of retailers we run test sales in:

independent stores

Your product needs to be tested by the U.S. market?

smaller chains (5-10 stores)

unconventional retailers

Liberty Trade Inc. sells its products in the highly profitable organic & natural food segment:

Buying raw products low

developing product lines quickly

selling our products high

in ecologically clean regions

according to American market trends

in U.S. premium supermarket chains

40%

of net profit

per every unit sold

Total Addressable Market (U.S. Natural & Organic) is valued at

$206 billion

brings up to

Get Involved!

Liberty Trade Inc. now working with Simex exchange! Click here

* - not available for residents of the United States of America

Hottest new products

on the American organic

food market

on the American organic

food market

We develop, launch, manage and distribute grocery product lines that disrupt traditional food market categories and generate extra attention of buyers in U.S. and beyond

our brands

1/3

BRISLING

SARDINES

SARDINES

record-breaking quick entry into

Whole Foods market

Whole Foods market

Natural & organic groceries

- the fastest-growing

The food segment in the U.S.

- the fastest-growing

The food segment in the U.S.

CAGR: +3,4%

CAGR: + 4,2%

CAGR: +7,6%

$5.75 trillion

total retail and food services sales in the U.S.A.

grocery store sales in the U.S.A.

$655.14 billion

Natural and Organic

Product Industry

Product Industry

$206 billion

Food market is growing

steadily and has no history

of rapid crashes.

steadily and has no history

of rapid crashes.

On this stable market we target our products and sell them in the «natural & organic» category which is developing

x2 quicker and is bringing

x4 more profit than the industry average.

Hottest new products

on the American organic

food market

on the American organic

food market

We develop, launch, manage and distribute grocery product lines that disrupt traditional food market categories and generate extra attention of buyers in U.S. and beyond

our brands

3/3

CRUNCH

INSTINCT

INSTINCT

world's first food product to acquire

«Global Footprint Network» certificate

«Global Footprint Network» certificate

40% net profit per product unit sold

financial benefits of natural & organic segment

financial benefits of natural & organic segment

+ 10%

+ 25%

+ 60%

+ 90%

+ 40%

Product

Logistics, customs

Sales costs

Distributor's margin

Retailer's margin

Brand owner's

(Liberty Trade Inc.)

royalties/net profit

(Liberty Trade Inc.)

royalties/net profit

Sales channel

markup

markup

Producer's price

FCA Good Price

* - the calculation presented above is based on historic performance of product brands owned/managed by Liberty Trade Inc. and its affiliates.

Organic & Natural is a premium food market segment where the brand owner (investor) can generate more profit thanthe manufacturer of the product.

40%

Brand owner's

(investor's) net profit

(investor's) net profit

~ 40%

~ 11%

of producer's FCA price

of shelf price

BASE

SHELF PRICE

All key functions in-house

Sourcing

We allocate best new products in Earth's ecologically cleanest locations.

Our own U.S. team and selected contractors allow us to perform express research to pinpoint market gap for a new product quickly and at a fraction of a cost.

Product niche

search

search

Product adaptation

for U.S.

for U.S.

We completely re-brand the product to fit a specific gap in the U.S. market. This is why each of our products our every new product becomes a hit. Our investors and/or suppliers become co-owners of a new brand.

Certification

Our R&D team has vast experience with obtaining mandatory and voluntary certificates that are crucial for the success of the product in organic food supermarkets.

Liberty's team of brand managers and sales reps test the new product by selling it to independent stores. By doing this we minimize risk of losing money on big sales.

Test sales

Nationwide sales

and distribution

in the U.S.

and distribution

in the U.S.

We use our direct contracts with largest organic and natural food supermarket chains to sell market-tested products all over America.

for maximum transparency, speed, and profits

All key functions in-house

Sourcing

We allocate best new products in Earth's ecologically cleanest locations.

Our own U.S. team and selected contractors allow us to perform express research to pinpoint market gap for a new product quickly and at a fraction of a cost.

Product niche

search

search

Product adaptation

for U.S.

for U.S.

We completely re-brand the product to fit a specific gap in the U.S. market. This is why each of our products our every new product becomes a hit. Our investors and/or suppliers become co-owners of a new brand.

Certification

Our R&D team has vast experience with obtaining mandatory and voluntary certificates that are crucial for the success of the product in organic food supermarkets.

Liberty's team of brand managers and sales reps test the new product by selling it to independent stores. By doing this we minimize risk of losing money on big sales.

Test sales

Nationwide sales

and distribution

in the U.S.

and distribution

in the U.S.

We use our direct contracts with largest organic and natural food supermarket chains to sell market-tested products all over America.

for maximum transparency, speed, and profits

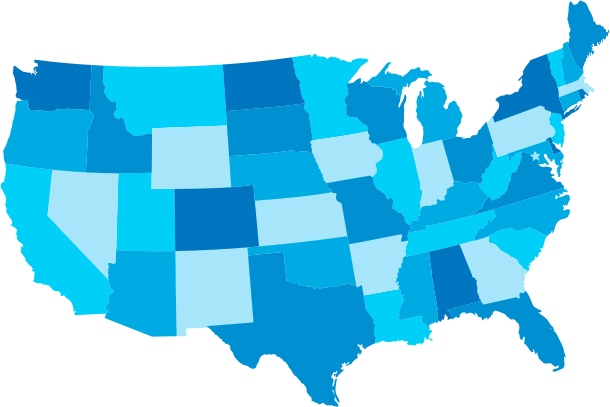

Current market coverage

(direct contracts of Liberty Trade Inc. and affiliate companies)

Retail

Our current network allows access to 30.000 stores across North America

Distribution

Active contracts with largest healthy food distributors

Geography

30.000

43 states

Most prominent American natural/organic supermarket chains and online retailers

supermarkets

Existing contracts and interest of buyers for current lines of products allow Liberty Trade Inc. to expand number of

supermarkets serviced and sales volumes 10x fold within 24 months. This is what the bulk of the investment is to be used for.

Get Involved!

Liberty Trade Inc. now working with Simex exchange! Click here

* - not available for residents of the United States of America

Brisling Sardines

product line developed

product line developed

Brisling Sardines

launched in US

launched in US

UNFI contracted

for Brisling Sardines

for Brisling Sardines

largest natural and organic food distributor

Brisling Sardines

enter Whole Foods Market

enter Whole Foods Market

I'm Vegan

is premiered at ExpoWest,

37 pre-orders received

is premiered at ExpoWest,

37 pre-orders received

I'm Vegan

product line developed

product line developed

world's top organic food

supermarket chain owned by Amazon

supermarket chain owned by Amazon

Brisling Sardines

begin selling at Amazon

begin selling at Amazon

Brisling Sardines

sales begin in Latin America

sales begin in Latin America

Crunch Instinct

product developed

product developed

Crunch Instinct

named among «summer's

hottest new products»

by Bakery news

named among «summer's

hottest new products»

by Bakery news

Crunch Instinct

received world's first

«Global Footprint Network» certificate

received world's first

«Global Footprint Network» certificate

Brisling Sardines

sales begin in Belgium

sales begin in Belgium

Total units produced to date

Product performance

and road map

and road map

23 million pcs*

* - including sales outside Americas by affiliate companies

Brisling Sardines

line extension

5 ⠀⠀ 15 SKUs

line extension

5 ⠀⠀ 15 SKUs

Brisling Sardines market coverage expansion

2.300 ⠀⠀10.000 stores

2.300 ⠀⠀10.000 stores

Crunch Instinct

reaching market coverage of 5.000

stores

reaching market coverage of 5.000

stores

adding: ACME, Costco, Giant Eagle, Harris Tetter

adding: ACME, Costco, Giant Eagle, Harris Tetter

total units sales: 2,88m

total net profit: $876k

total net profit: $876k

I'm Vegan

reaching market

coverage

of 5.000 stores

reaching market

coverage

of 5.000 stores

adding: Publix, Fresh Market, Albretsons, Shop Rite

2020 FORECAST

* - the calculation presented here is based on historic performance of product brands owned/managed by Liberty Trade Inc. and its affiliates. The calculation is a subjective estimate and is provided for information purposes only.

I'm Vegan

line extension

6⠀⠀ 12 SKUs

line extension

6⠀⠀ 12 SKUs

Crunch Instinct

line extension

4⠀⠀ 7 SKUs

line extension

4⠀⠀ 7 SKUs

All brands

U.S. market coverage

reaching 12.000 stores

U.S. market coverage

reaching 12.000 stores

total units sales: 18,19m

total net profit: $5,68m

total net profit: $5,68m

Brisling Sardines

market entry:

U.K., Arabian Peninsula

market entry:

U.K., Arabian Peninsula

2021 FORECAST

* - the calculation presented here is based on historic performance of product brands owned/managed by Liberty Trade Inc. and its affiliates. The calculation is a subjective estimate and is provided for information purposes only.

NEW

trade mark launch

trade mark launch

Crunch Instinct

line extension

7⠀⠀ 12 SKUs

line extension

7⠀⠀ 12 SKUs

I'm Vegan

line extension

12 ⠀⠀16 SKUs

line extension

12 ⠀⠀16 SKUs

total units sales: 28,38m

total net profit: $7,11m

total net profit: $7,11m

Brisling Sardines

market entry:

Canada, Brazil, Argentina,

Germany, France

market entry:

Canada, Brazil, Argentina,

Germany, France

2022 FORECAST

* - the calculation presented here is based on historic performance of product brands owned/managed by Liberty Trade Inc. and its affiliates. The calculation is a subjective estimate and is provided for information purposes only.

All brands

U.S. market coverage

reaching 18.000 stores

U.S. market coverage

reaching 18.000 stores

I'm Vegan

market entry:

U.K, Canada, Brazil,

Argentina, Germany,

France

market entry:

U.K, Canada, Brazil,

Argentina, Germany,

France

Crunch Instinct

market entry:

U.K, Canada, Brazil,

Argentina, Germany,

France

market entry:

U.K, Canada, Brazil,

Argentina, Germany,

France

total units sales: 37m

total net profit: $10,02m

total net profit: $10,02m

NEW

trade mark line

extension

trade mark line

extension

2023 FORECAST

* - the calculation presented here is based on historic performance of product brands owned/managed by Liberty Trade Inc. and its affiliates. The calculation is a subjective estimate and is provided for information purposes only.

2016

2017

2018

2019

2020

2021

2022

2023

PAST

FUTURE

Scailing of business

Get Involved!

Liberty Trade Inc. now working with Simex exchange! Click here

* - not available for residents of the United States of America

( Brisling Sardines, I'm Vegan, Crunch Instinct):

adding: Salmon and Tuna

Get Involved!

Liberty Trade Inc. now working with Simex exchange! Click here

* - not available for residents of the United States of America

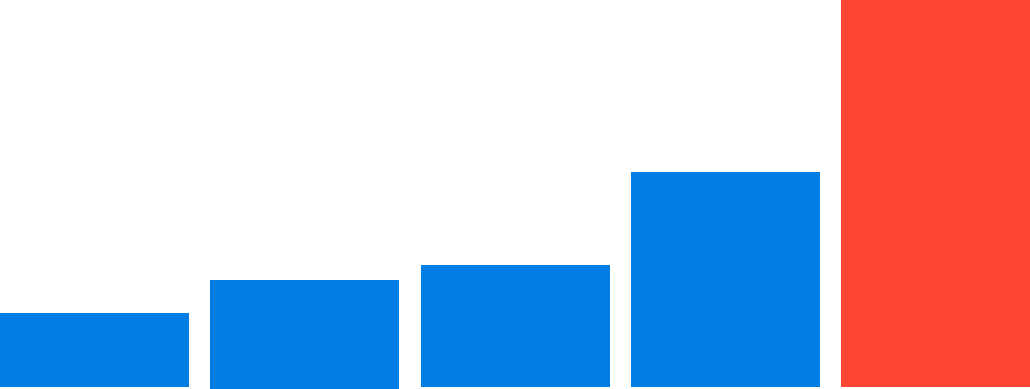

Financials

projected earnings

projected earnings

Liberty Trade Inc. will distribute 40% of the company's annual profits

among holders of preferred stock starting December 2020.

among holders of preferred stock starting December 2020.

Projected earning of preferred

shares per $1.000 invested in 2019:

shares per $1.000 invested in 2019:

* - the calculation presented here is a subjective estimate and is for information purposes only

351 USD

2 273 USD

2 844 USD

4 007 USD

9 475 USD

2020

2021

2022

2023

Total:

2020-2023

2020-2023

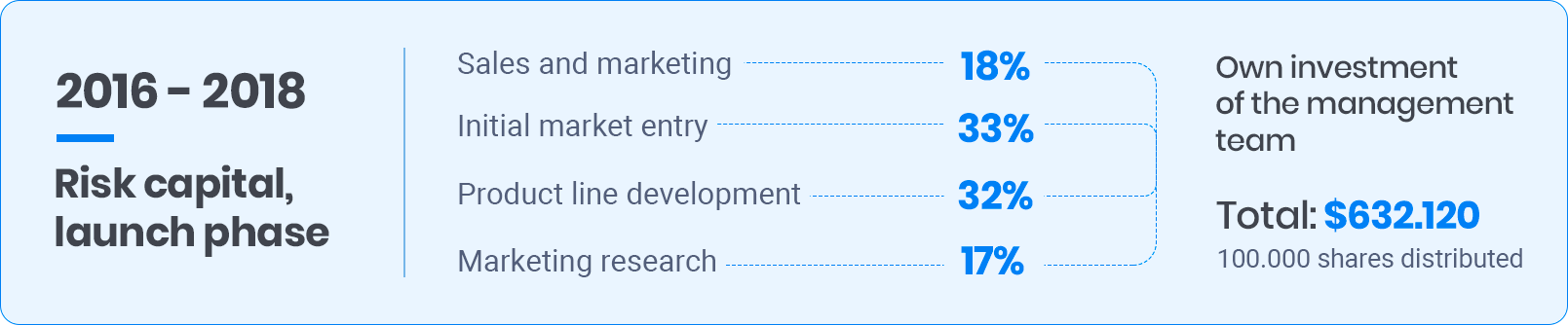

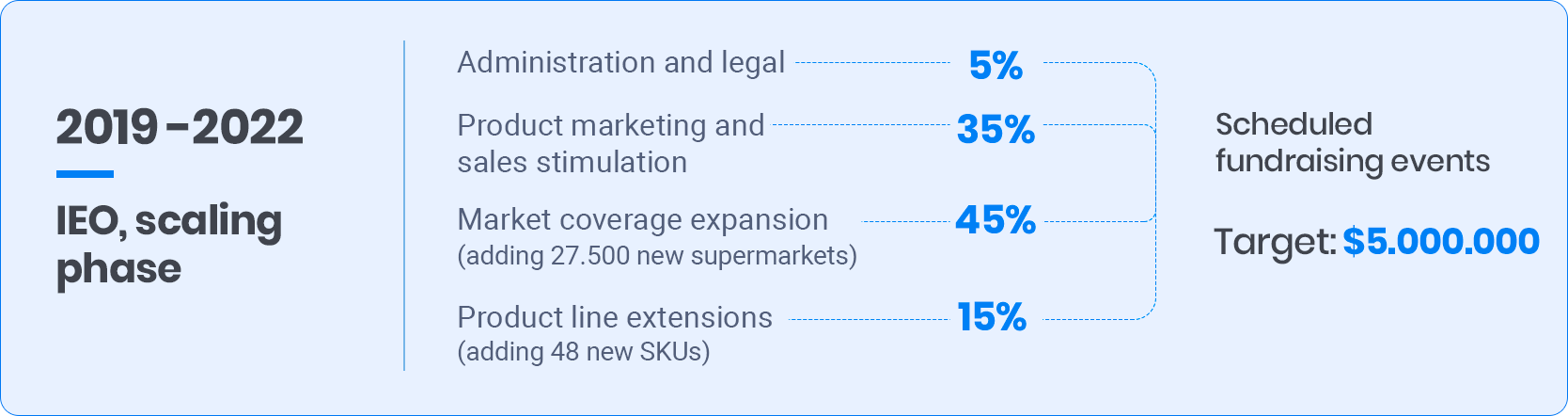

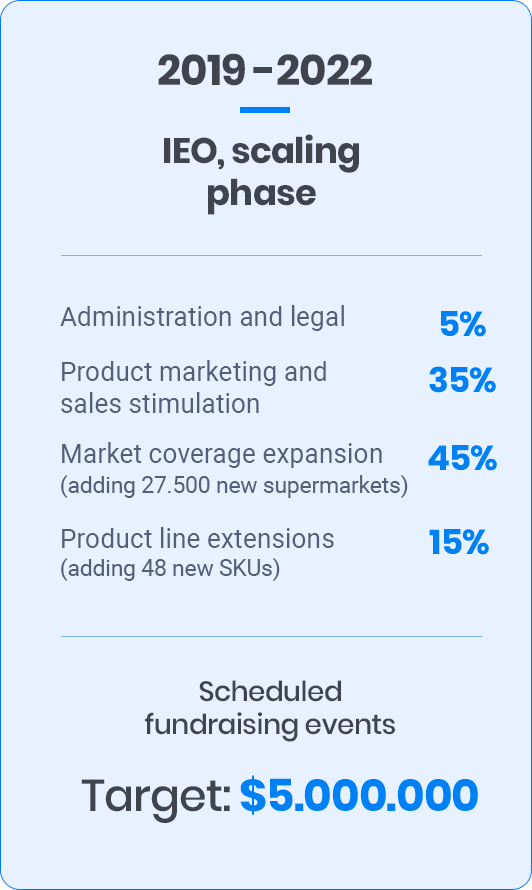

Scaling the success

phases of business development

phases of business development

Please request complete business model here

Income

2020

2021

2022

2023

2020-2023

Income

Income of "Brisling Sardines" brand

Income of

"I`M Vegan" brand

"I`M Vegan" brand

Income of "Crunch Instinct" brand

Cost of Goods Sold

Gross Profit

4 175 180 $

26 074 980 $

40 731 498 $

53 167 644 $

124 149 302 $

1 556 180 $

6 279 120 $

9 167 256 $

12 603 816 $

29 606 372 $

1 188 000 $

8 577 360 $

13 642 992 $

17 559 828 $

40 968 180 $

1 431 000 $

11 218 500 $

17 921 250 $

23 004 000 $

53 574 750 $

2 178 800 $

14 587 400 $

24 603 686 $

31 763 786 $

73 133 672 $

1 996 380 $

11 487 580 $

16 127 812 $

21 403 858 $

51 015 630 $

Expenses

2020

2021

2022

2023

2020-2023

Storage & Delivery

174 737 $

1 016 432 $

1 590 433 $

2 114 119 $

4 895 721 $

Broker fees

175 394 $

1 226 751 $

1 913 244 $

2 500 337 $

5 815 726 $

Administration Cost

286 970 $

1 140 343 $

1 554 746 $

1 990 012 $

4 972 071 $

Sales Force

118 000 $

211 000 $

294 000 $

294 000 $

917 000 $

Marketing Operation Cost

170 489 $

1 471 999 $

2 474 260 $

2 971 706 $

7 088 454 $

Promotion Activities

114 439 $

278 375 $

383 657 $

445 838 $

1 222 309 $

Tax

79 855 $

459 503 $

806 391 $

1 070 193 $

2 415 942 $

Total Expenses

1 119 885 $

5 804 403 $

9 016 731 $

11 386 204 $

27 327 223 $

Net Income

876 495 $

5 683 177 $

7 111 081 $

10 017 654 $

23 688 407 $

2020

2021

2022

2023

2020-2023

Balance Start

20 000 $

1 472 628 $

5 320 746 $

12 102 375 $

20 000 $

Receivable Balance (inc. IEO) invest.)

6 064 360 $

10 585 205 $

15 394 980 $

19 436 249 $

51 480 794 $

Expenses

996 303 $

5 351 601 $

8 613 352 $

11 072 350 $

26 033 606 $

Investments

3 615 429 $

1 385 486 $

0 $

0 $

5 000 915 $

Balance End

1 472 628 $

5 320 746 $

12 102 375 $

20 466 274 $

20 466 273 $

Get Involved!

Liberty Trade Inc. now working with Simex exchange! Click here

* - not available for residents of the United States of America

Core team

and advisory board

and advisory board

Nikita Kellermann

President

Developed, launched and led projects in the field of consumer goods and food supplements for PepsiCo, STADA AG, Avon and more. Marketed investment/ M&A projects totaling $350m. Founded and financed charitable projects in Europe and Russia.

Alyssa Young

Sales & Marketing

Product director, marketer and brand leader for grocery, food supplement and hi-tech

projects. Market experience in United States, Europe and Japan.

projects. Market experience in United States, Europe and Japan.

Alexey Mikhailov

Technical director

Vast experience as a general manager and crisis-manager of food production plants as well as production of mineral fertilizers. Managed projects with budgets exceeding $400m.

Leo Baev

Product development

Led major product development projects for grocery, non-food FMCG and pharmaceutical

companies. Experienced with managing creative teams

scattered all over the world.

companies. Experienced with managing creative teams

scattered all over the world.

Oscar Ozols

Product certification

and FDA compliance

and FDA compliance

Owner and general manager of Tuev-Sued representative

office - one of the world's major certification and industrial

maintenance companies.

office - one of the world's major certification and industrial

maintenance companies.

Jessica Morrisson

Market evaluation

and product testing

and product testing

Broad experience in the field on European and North

American markets.

American markets.

Keira Rathner

Legal, intellectual

property protection

property protection

Practices American and

European law. Holds a customer base in 15 countries, including industry leading companies.

European law. Holds a customer base in 15 countries, including industry leading companies.

Get in touch!

2300 West Sahara, office 400, Las Vegas, 89102

HQ address:

E-mail: